CannaCoverage is at the forefront of a transformative movement as cannabis evolves from the fringes of legality into a mainstream industry. A full-service consultant and insurance brokerage firm dedicated to the cannabis, CBD and hemp sectors, CannaCoverage empowers businesses to thrive in a landscape characterized by complex regulatory and operational demands.

Cannabis is poised to be rescheduled from a Schedule I to a Schedule III drug, opening up new opportunities for entrepreneurs. CannaCoverage provides expert guidance to help them seize these opportunities by overcoming challenges.

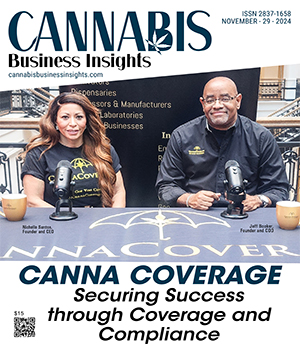

It offers a full portfolio of commercial business insurance, along with risk management and compliance services to help businesses avoid fines, violations and prevent claims from ocurring. “Focusing on compliance and risk management, we enable companies to streamline operations, reduce risk exposure and prioritize growth,” says Jeff Booker, founder and COO, and a seasoned insurance professional with three decades of experience in health benefits and risk management.

CannaCoverage also provides core employee benefits like medical, prescription and life insurance products, ensuring that cannabis businesses can offer competitive employment packages that attract and retain top talent. What separates them from the pack is the offering of medical cannabis as a benefit to transform healthcare.

Empowering Cannabis Businesses to Succeed

CannaCoverage equips its clients with the protection and confidence to succeed in the industry, regardless of their size—from startup to multi-state operator. The firm works with every part of the supply chain, from cultivators and manufacturers to distributors and dispensaries. Its business solutions mitigate risks, boost income, and contribute to community tax revenue, all while prioritizing public safety and health.

Specialized insurance is a must-have in the cannabis industry. Yet, 85 percent of small cannabis companies remain underinsured, in not protecting all aspects of the business. Founder and CEO, Nichelle Santos, stated, “it’s imperative that business owners understand the risks inherent to the cannabis industry, protect the risk with risk management strategies and a full suite of insurance coverage depending on the sector of business.” CannaCoverage bridges this gap, expertly identifying carriers that offer insurance designed for the cannabis industry. This includes everything from general liability to product liability, property, crop coverage, cannabis auto and employment practices liability, director's and officer's liability insurance, and more.

CannaCoverage employs a structured process to assess and manage insurance and risk for businesses, starting with a discovery questionnaire to understand the client's needs. This process includes three key components—risk assessment, tailored risk mitigation plans and securing appropriate insurance solutions. This approach is designed to safeguard cannabis businesses on multiple fonts, including slip-and-fall claims in dispensaries, product liability from cannabinoid products, and property loss from fire or theft.

Compliance is another crucial aspect in the industry, particularly due to federal illegality and varying state regulations. Cannabis legalization spans 40 states, and CannaCoverage ensures clients meet all regulatory requirements, covering aspects such as HR practices, vendor contracts, packaging regulations, health and safety, and more. It helps clients navigate regulatory complexities and avoid fines and violations that could threaten their operations, especially for small businesses affected by tax codes like 280E that cut into profit margins.

Leading the Way with Medicinal Cannabis

CannaCoverage brings innovation by incorporating medical cannabis into employee health plans as an alternative with significant health and financial benefits, they have partnered with Bennabis Health to bring this to employer groups. Santos stated, “We are pleased to partner with Bennabis Health at a pivotal moment in history, as cannabis is legalized in the majority of states across the U.S. The opportunity for cannabis to be rescheduled, allows a pathway for medical cannabis as a multi-modal option and alternative to opioids and other synthetic prescription drugs. We have witnessed the destruction of lives and families with opioid abuse. Having medical cannabis as an option will improve health outcomes and workforce production, reduce addiction rates, and increase quality of life.”

Booker stated, "Not only is this morally the right thing to do, but there is also an economic impact. This is an opportunity to bring medical cannabis to mainstream America in all industries, not just employers of the cannabis & hemp industries. Through this alternative medical cannabis benefit, a tremendous cost savings will be realized in reduction of skyrocketing medical claims and prescription benefits, to impact the bottom line."

The firm also offers ketamine-assisted therapy for mental health and pain management, presenting effective alternatives to addictive prescriptions. Through tailored insurance solutions and partnerships with specialized providers, CannaCoverage navigates federal restrictions, diverse state laws and insurance challenges, enabling more companies to include medical cannabis and psychedelics in their health benefits.

Santos who is an accomplished entrepreneur and risk management expert dedicated to building an equitable and sustainable cannabis industry, also serves as the New Jersey State Co-Director of Minorities For Medical Marijuana, stated, "We are driving real change—showing that medical cannabis and psychedelics are not just an alternative, but a vital part of the future of healthcare."

As more businesses partner with CannaCoverage, individuals suffering from serious health conditions are finding new hope.

For instance, a woman diagnosed with multiple sclerosis in 2013 faced the daunting prospect of relying on Copaxon, a prescription drug notorious for its severe side effects and high cost. She made the personal decision to choose medical cannabis as a replacement to the prescribed medication. She paid out of her own pocket, as the benefit was not available then. Eleven years later, she's healthy, still practicing law; and didn't have to suffer, nor monitor her heart, liver, and kidney from the adverse effects of Copaxone. The time is now to offer these alternative treatments scaling patient access and affordability just like any other prescribed medication.

CannaCoverage is making strides by integrating medicinal cannabis into employee benefits, starting with a significant municipality with over 1,200 employees, in New Jersey, the City of Trenton; and now with more public entities in the pipeline.

As the public sector takes the lead, CannaCoverage urges the cannabis industry to follow suit. Many companies are overlooking the opportunity to leverage the plant's potential and save up to $1,600 per employee annually.

Prioritizing compliance and holistic health solutions, CannaCoverage empowers businesses to thrive, establishing itself as the preferred partner in navigating the ever-complex cannabis landscape.

Cannabis is poised to be rescheduled from a Schedule I to a Schedule III drug, opening up new opportunities for entrepreneurs. CannaCoverage provides expert guidance to help them seize these opportunities by overcoming challenges.

It offers a full portfolio of commercial business insurance, along with risk management and compliance services to help businesses avoid fines, violations and prevent claims from ocurring. “Focusing on compliance and risk management, we enable companies to streamline operations, reduce risk exposure and prioritize growth,” says Jeff Booker, founder and COO, and a seasoned insurance professional with three decades of experience in health benefits and risk management.

CannaCoverage also provides core employee benefits like medical, prescription and life insurance products, ensuring that cannabis businesses can offer competitive employment packages that attract and retain top talent. What separates them from the pack is the offering of medical cannabis as a benefit to transform healthcare.

Empowering Cannabis Businesses to Succeed

CannaCoverage equips its clients with the protection and confidence to succeed in the industry, regardless of their size—from startup to multi-state operator. The firm works with every part of the supply chain, from cultivators and manufacturers to distributors and dispensaries. Its business solutions mitigate risks, boost income, and contribute to community tax revenue, all while prioritizing public safety and health.

Specialized insurance is a must-have in the cannabis industry. Yet, 85 percent of small cannabis companies remain underinsured, in not protecting all aspects of the business. Founder and CEO, Nichelle Santos, stated, “it’s imperative that business owners understand the risks inherent to the cannabis industry, protect the risk with risk management strategies and a full suite of insurance coverage depending on the sector of business.” CannaCoverage bridges this gap, expertly identifying carriers that offer insurance designed for the cannabis industry. This includes everything from general liability to product liability, property, crop coverage, cannabis auto and employment practices liability, director's and officer's liability insurance, and more.

CannaCoverage employs a structured process to assess and manage insurance and risk for businesses, starting with a discovery questionnaire to understand the client's needs. This process includes three key components—risk assessment, tailored risk mitigation plans and securing appropriate insurance solutions. This approach is designed to safeguard cannabis businesses on multiple fonts, including slip-and-fall claims in dispensaries, product liability from cannabinoid products, and property loss from fire or theft.

We work with every part of the supply chain—from cultivators and dispensaries to manufacturers and transporters—providing tailored risk management and compliance solutions

Compliance is another crucial aspect in the industry, particularly due to federal illegality and varying state regulations. Cannabis legalization spans 40 states, and CannaCoverage ensures clients meet all regulatory requirements, covering aspects such as HR practices, vendor contracts, packaging regulations, health and safety, and more. It helps clients navigate regulatory complexities and avoid fines and violations that could threaten their operations, especially for small businesses affected by tax codes like 280E that cut into profit margins.

Leading the Way with Medicinal Cannabis

CannaCoverage brings innovation by incorporating medical cannabis into employee health plans as an alternative with significant health and financial benefits, they have partnered with Bennabis Health to bring this to employer groups. Santos stated, “We are pleased to partner with Bennabis Health at a pivotal moment in history, as cannabis is legalized in the majority of states across the U.S. The opportunity for cannabis to be rescheduled, allows a pathway for medical cannabis as a multi-modal option and alternative to opioids and other synthetic prescription drugs. We have witnessed the destruction of lives and families with opioid abuse. Having medical cannabis as an option will improve health outcomes and workforce production, reduce addiction rates, and increase quality of life.”

Booker stated, "Not only is this morally the right thing to do, but there is also an economic impact. This is an opportunity to bring medical cannabis to mainstream America in all industries, not just employers of the cannabis & hemp industries. Through this alternative medical cannabis benefit, a tremendous cost savings will be realized in reduction of skyrocketing medical claims and prescription benefits, to impact the bottom line."

The firm also offers ketamine-assisted therapy for mental health and pain management, presenting effective alternatives to addictive prescriptions. Through tailored insurance solutions and partnerships with specialized providers, CannaCoverage navigates federal restrictions, diverse state laws and insurance challenges, enabling more companies to include medical cannabis and psychedelics in their health benefits.

Santos who is an accomplished entrepreneur and risk management expert dedicated to building an equitable and sustainable cannabis industry, also serves as the New Jersey State Co-Director of Minorities For Medical Marijuana, stated, "We are driving real change—showing that medical cannabis and psychedelics are not just an alternative, but a vital part of the future of healthcare."

As more businesses partner with CannaCoverage, individuals suffering from serious health conditions are finding new hope.

For instance, a woman diagnosed with multiple sclerosis in 2013 faced the daunting prospect of relying on Copaxon, a prescription drug notorious for its severe side effects and high cost. She made the personal decision to choose medical cannabis as a replacement to the prescribed medication. She paid out of her own pocket, as the benefit was not available then. Eleven years later, she's healthy, still practicing law; and didn't have to suffer, nor monitor her heart, liver, and kidney from the adverse effects of Copaxone. The time is now to offer these alternative treatments scaling patient access and affordability just like any other prescribed medication.

CannaCoverage is making strides by integrating medicinal cannabis into employee benefits, starting with a significant municipality with over 1,200 employees, in New Jersey, the City of Trenton; and now with more public entities in the pipeline.

As the public sector takes the lead, CannaCoverage urges the cannabis industry to follow suit. Many companies are overlooking the opportunity to leverage the plant's potential and save up to $1,600 per employee annually.

Prioritizing compliance and holistic health solutions, CannaCoverage empowers businesses to thrive, establishing itself as the preferred partner in navigating the ever-complex cannabis landscape.

Company : CannaCoverage

Headquarters :

. ManagementNichelle Santos, Founder and CEO, Jeff Booker, Founder and COO

Thank you for Subscribing to Cannabis Business Insights Weekly Brief